Illicit financial flows. The Big Business.

It is a fact that the tax systems of developing countries are severely constrained by lack of adequate legislation, deep-rooted weak democratic institutions and pervasive corruption. Tax systems’ collection shortfalls are mainly due to low Gross Domestic Product (GDP) per capita, poverty and illicit financial flows (IFF).

Therefore, in order to increase the tax revenues in such countries, it would be necessary to increase the fiscal space (Domestic Revenue Mobilisation) in a progressive way without affecting the poorest. With a fair and progressive increase in taxes on the wealth of companies and citizens, developing countries can collect more money and allocate it to public services that benefit their citizens, such as infrastructure, education or health.

In developing countries, income and expenditure management (tax systems) play a key role in poverty eradication and sustainable development. In fact, the Sustainable Development Goals in their target 16.4 point to the reduction of IFFs along with the return of stolen assets as a means to achieve sustainable development.

Thus, while effective and efficient use of the tax system has a positive effect on the public services provided to the population, a mismanagement of the tax system leads to behaviours that results in illicit financial flows, which is particularly serious in Africa and mainly in those countries that are rich in natural resources.

A clear example of this mismanagement of the tax system is the data showing that African countries are losing US$50 Billion a year on Illicit financial flows and that this amount is greater than all the Official Development Assistance (ODA) the continent receives. There are two main reasons for IFF: first, a national bad management on their tax systems. And second, it is due to the weakness of an international tax system control. Although the main responsibility in the tax system lies with national governments; in a globalized economy, international cooperation mechanisms and global tax reforms are needed to prevent multinationals from taking advantage of legal loopholes to evade or avoid paying taxes. But what are we referring to when we talk about Illicit Financial flows?

According to the report of the High-level Panel on Illicit Financial Flows from Africa of 2015, Illicit Financial Flows (IFF) is “money that is illegally earned, transferred or utilized. This funds typically originate from three sources: commercial tax evasion, trade misinvoicing and abusive transfer pricing: including criminal activities… and bribery and theft of government officials”. This definition allows us a better understanding of why the activity generated with the extractive industry (oil, gas and minerals) is directly responsible for the loss of domestic revenues by countries rich in natural resources.

It is estimated that developing countries raise only 65 per cent of the potential revenue they could raise, and out of that amount, the extractive industry is responsible for 60-65 per cent of the money defrauded in Africa. These illicit behaviours and inefficiency in revenue collection make it necessary to review the tax systems to improve the capacity to collect taxes and to establish international control mechanisms to the practices of the extractive industry. Among these illicit behaviors we highlight the three most common practices in the IFF:

Tax Avoidance. In principle, this practice would be within legal limits. Multinationals in their strategy to reduce production costs would in parallel develop an aggressive tax strategy in which they would minimize amounts to be paid in taxes by taking advantage of the national legislation and complex corporate structures. In these cases, companies would study the legal gaps in order to benefit from tax exemptions provided for in the tax law. That is, large corporations with astronomical economic benefits that would cling to legal arguments to stop contributing in the countries where they develop their extractive activities. Although a priori these practices would be legal, they are still unethical business practices, incompatible with corporate social responsibility established by all international standards.

Tax Evasion. This illicit conduct clearly means illegal fraud actions in which the large corporations fails to pay the amount due for the benefits obtained. Multinational companies involved in resource extraction are particularly effective at paying only a small share of the taxes that they owe. It happens when extractive companies try to avoid paying taxes by falsifying and concealing certain data with which the amounts to be paid are determined, such as the quantities of ore extracted, the price received by them, the profits obtained by the company, payments made to local authorities and officials to obtain licenses, etc. These actions are considered tax offences and are punishable by a fine and even imprisonment. Moreover, tax evasion in African countries deprives governments of the ability to provide public services, such as healthcare and education, to the 413 million people living below the poverty line.

Transfer pricing. This practice refers to the rules and methods for pricing transactions within and between companies under common ownership or control. These companies operate in different countries and realize transactions to distort the real incomes. To carry out these practices, companies use complex corporate structures within the same corporate group. Sometimes these companies have their headquarters in tax havens where hardly any companies are taxed.

The companies declare few profits in ordinary activity, distort the purchase and sale prices of raw materials, and make purchases and sales between companies in the same group, always declaring losses in developing countries and declaring profits in tax havens

where they are hardly taxed.

But who benefits most by these illicit conducts?

What is striking is that companies use legal tricks for their illegal and illicit practices. These practices are covered by national and international legal tax systems and therefore protected by politicians, policy makers and officials. The only beneficiaries are the corporations that certainly do not pay taxes in developing countries and neither do they in the rich countries because they use the corporate structures to tax in tax havens.

So why do politicians, policy makers and governments continue to resist changing the legislation? What part of the negotiations and agreements between big corporations, politicians and governments does not transcend to the citizens? Why do most European ministers and commissioners, at the end of their terms in office, end up being members of the boards of directors of large companies? Does it have anything to do with the revolving doors?

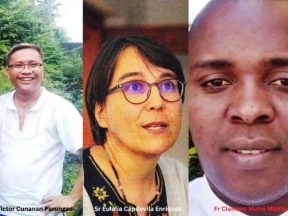

José Luis Gutiérrez Aranda,

Trade Policy Officer,

Africa Europe Faith and Justice Network (AEFJN)